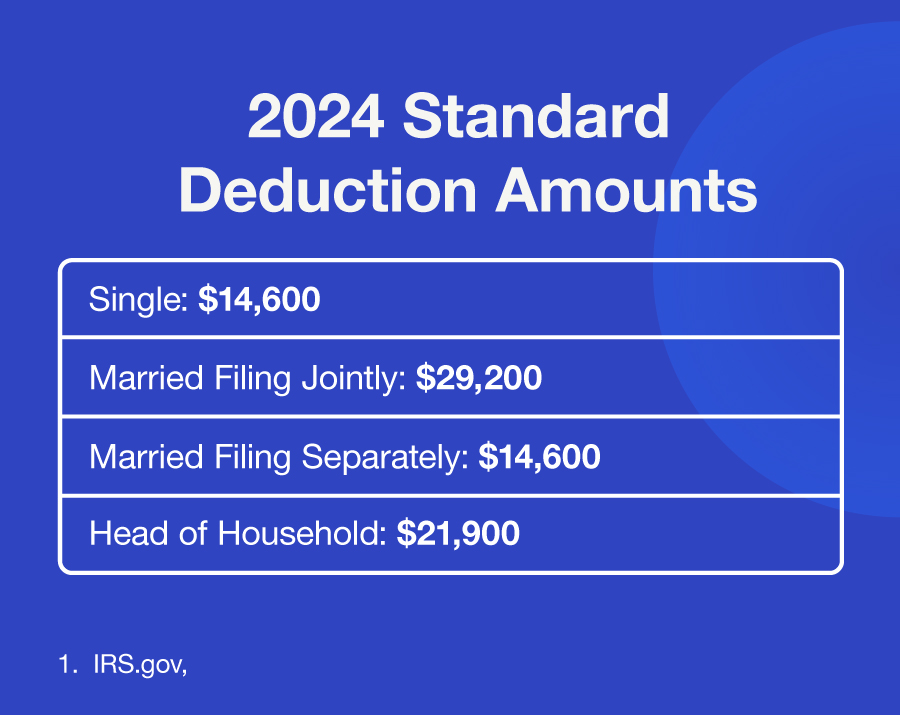

2024 Standard Tax Deduction Married Jointly 2024. For single taxpayers and married individuals filing separately, the standard deduction will rise to $14,600 for 2024, up $750 from this year; The irs released the 2024 standard deduction amounts for returns normally filed in april 2025.

For the tax year 2024, married couples filing jointly (those who are legally married and choose to file their taxes. If you make $70,000 a year living in new hampshire you will be taxed $7,660.

2024 Standard Tax Deduction Married Jointly 2024 Images References :

Source: www.trustetc.com

Source: www.trustetc.com

2024 Tax Brackets Announced What’s Different?, For single taxpayers, the 2024 standard deduction is $14,600, up $750 from 2023;

Source: kileymatilde.pages.dev

Source: kileymatilde.pages.dev

Irs Tax Brackets 2024 Married Jointly Lee Karalee, — the tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

Source: florqfrankie.pages.dev

Source: florqfrankie.pages.dev

Married Filing Joint 2024 Standard Deduction Zarla Lucina, A deduction reduces the amount of a taxpayer's income that's subject to tax, generally reducing the amount of tax the individual may have to pay.

Source: senabolivette.pages.dev

Source: senabolivette.pages.dev

2024 Tax Tables Married Filing Jointly Glenn Kalinda, A full deduction up to the amount.

Source: avrilqtrudey.pages.dev

Source: avrilqtrudey.pages.dev

Married Filing Jointly Tax Brackets 2024 Standard Deduction Kelli, The standard deduction for couples filing jointly will be $29,200, up $1,500 from 2023;

Source: almabmariette.pages.dev

Source: almabmariette.pages.dev

Married File Jointly Standard Deduction 2024 Allene Willamina, The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an.

Source: dolliqjuieta.pages.dev

Source: dolliqjuieta.pages.dev

Tax Brackets 2024 Married Jointly Calculator Elana Harmony, Single or head of household:

Source: laurenewrory.pages.dev

Source: laurenewrory.pages.dev

2024 Standard Tax Deduction Married Jointly 2024 Sonia Eleonora, The additional standard deduction amount will increase to $1,950 if the individual is.

Source: www.successionwealthplanning.com

Source: www.successionwealthplanning.com

What’s My 2024 Tax Bracket?, — for the 2024 tax year, the standard deduction will increase by $750 for single filers and those married filing separately, $1,500 for married filing jointly, and $1,100 for.

Source: almabmariette.pages.dev

Source: almabmariette.pages.dev

Married File Jointly Standard Deduction 2024 Allene Willamina, Seniors over age 65 may claim an additional standard deduction.

Posted in 2024